There are lots of different apps out there today to help you manage your personal finance. Due to the nature of financial apps some tend to cater to one geographic area as opposed to being global. We take a look at some of the best for the US, Canada & the UK. From aggregators to budgeting and investment, there are plenty of apps out there to help you manage your money.

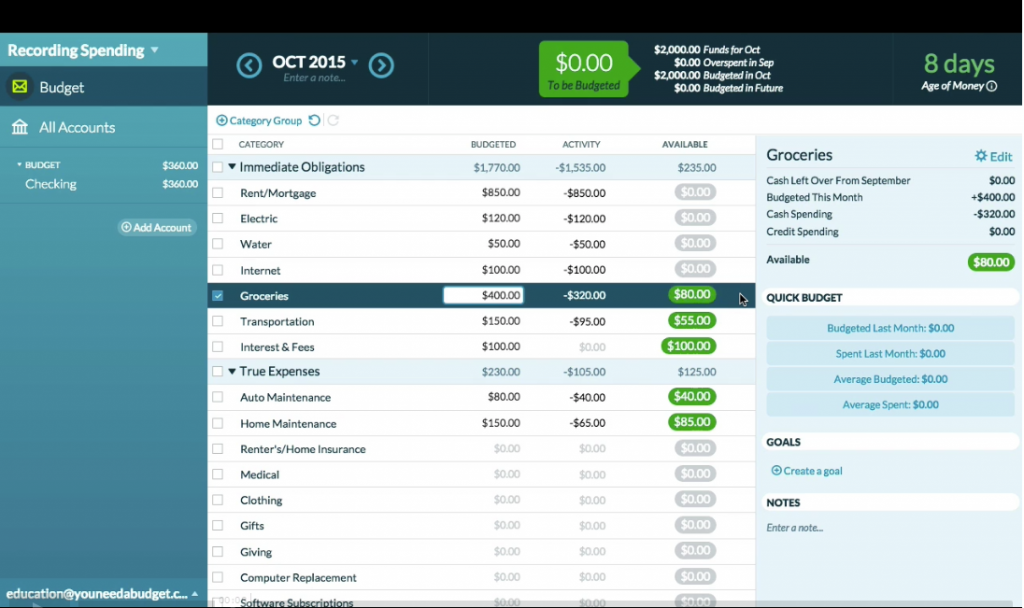

1 – You Need A Budget (YNAB)

The YNAB service has been a winner for some time now, their popular budgeting service is designed to help you understand what you are spending your money. Leading to your creating a buffer for future months so you can, as they say “stop living from pay check to pay check”.

https://www.youneedabudget.com/

2 – Prosper Daily (formerly BillGuard)

Formerly known as BillGuard and re-branded following an aquisition from Prosper Marketplace in September, the app continues to keep the focus that BillGuard did, harnessing the crowd to identify fraudulent transactions whilst building on this foundation.

Prosper themselves are a lending marketplace, offering peer lending so it is of course a good fit for their core business and their first app. From a users point of view the app is available on both iOS & Android and like many of the apps featured offers users an insight into their finances across multiple accounts.

https://www.prosper.com/daily/

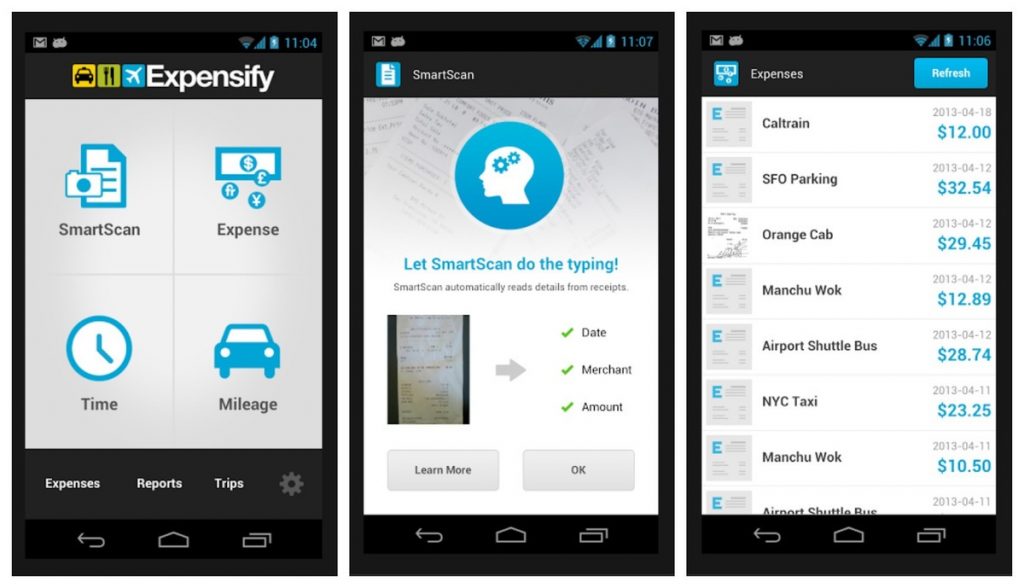

3 – Expensify

If you work in a job where you have to submit expenses, you will know the pain of having to collect and pull together all your receipts for the monthly submission Expensify seeks to remedy that pain with an easy to use receipt scanner, pulling your data direct from the receipt where possible, categorising expenses and producing an easy to ready report at the end.

4 – Spendee

Another contender in the budgeting and financial account aggregation sector, Spendee lets you view your spending at a glance and helps you to understand where your money is going.

5 – Money dashboard

With a UK focus Money Dashboard is a financial aggregator to help you understand where your money is going.

https://www.moneydashboard.com/

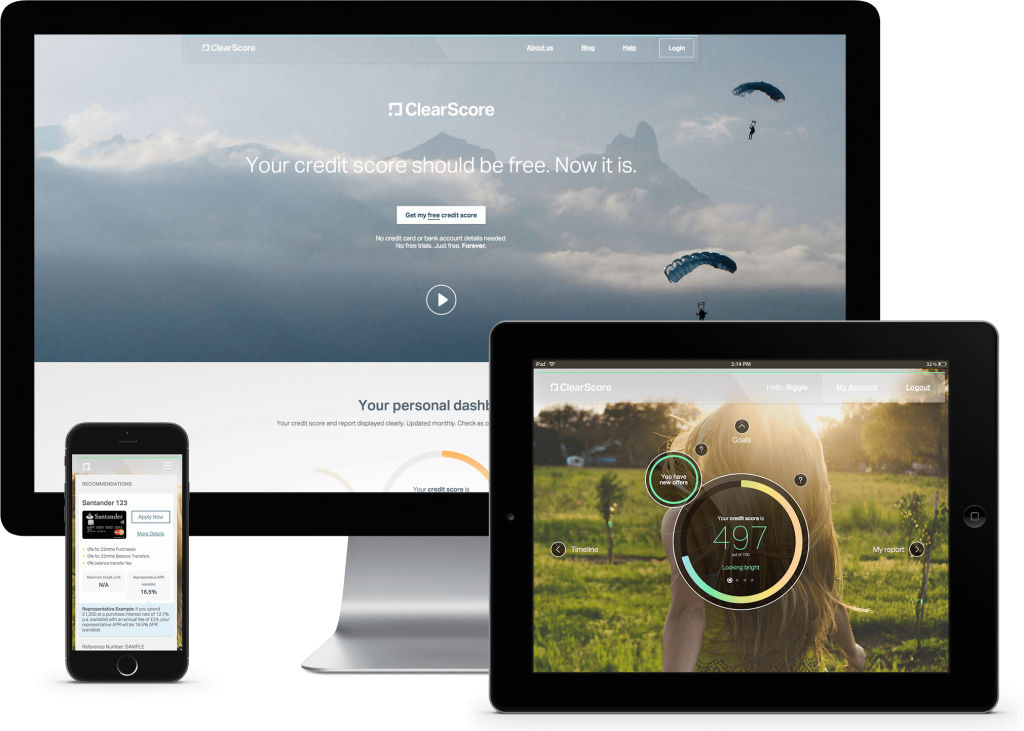

6 – Clearscore

Gone are the days of needing to pay to see your credit report, with ClearScore you can now see your report for free within minutes. The UK service is still in their minimum viable product mode by the feel of it, with many services such as their timeline reported as under development. It also needs to be considered that you are only part of the puzzle with their credit report source being Equifax (The rival Noddle is actually the Callcredit agency).

That being said the information is free and accurate, if you don’t mind giving away some of your data and being presented with financial offers.

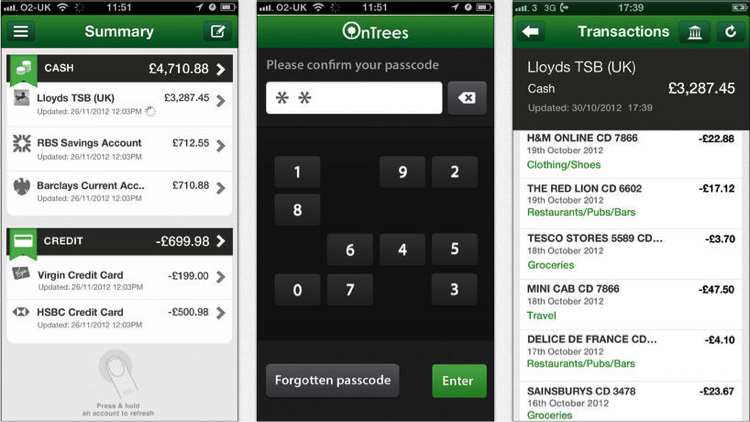

7 – OnTrees

The UK version of Mint if you will, offering similar services this aggregator is part of the MoneySuperMarket family.

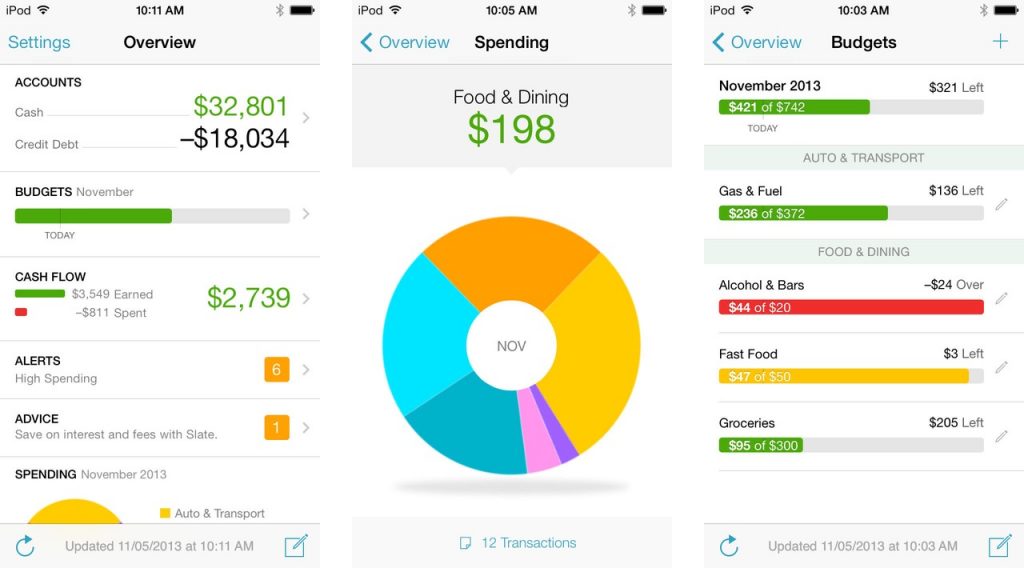

8 – Mint.com

With many millions of users, Mint is the granddaddy of the financial aggregators. By adding all your accounts it automatically connects and pulls your financial data into one user friendly dashboard with your spending categorised for analysis.

The service is only available in the US & Canada due, primarily down to the automatic part of the transaction scan, in many cases giving your login details to a 3rd party breaches your terms and conditions. That being said Mint is well used by a lot of people, their acquisition by Intuit sits them in good company alongside the companies Quicken product.

9 – Venmo

Part of the PayPal group, Venmo is a social micro-payment app that allows you to easily share payments with friends and family. Want to split that restaurant bill? No problem, with Venmo you can easily pay your share.

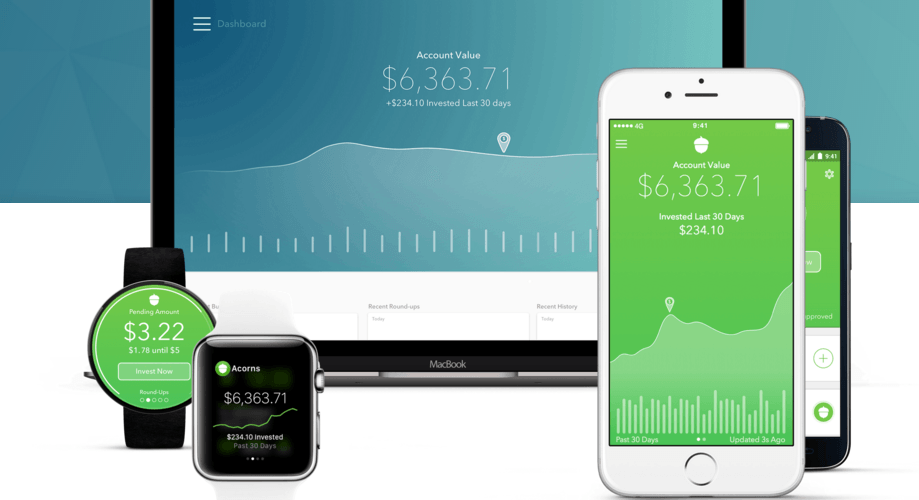

10 – Acorns

Acorns is a micro investment app that aims to get everyone investing the spare change from every-day transactions for US citizens. Spreading those investments over a wide portfolio to mitigate risk and with no transaction fee’s it is a low barrier entry to the world of investment.